So you’ve spent more years than you care to remember building your nest-egg to see you through the rest of your life in some comfort. Now, how to prevent the tax man getting his hands on a sizeable portion of it?

Most people will have heard of ‘tax havens’, but where are they, and what do they really provide you with that retaining your hard-earned wealth or investing in your home country does not? Investing through a trust or company based in a tax haven is a perfectly legal – the best tax havens offer low or no taxes even on personal income, as well as interest, capital gains and inheritance. Corporations reporting profits through headquarters, or even subsidiaries in countries with favourable taxation environments can obviously save billions. The super-wealthy also stand to save millions or even billions by taking advantage of the world’s best tax havens. So, the major benefit of a tax haven is saving on taxes.

Following, in no particular order, is a summary of 10 noted tax havens, and what the main attractions are which might persuade you to move all or some of liquid assets ‘off shore’. Interestingly, ‘off-shore’ is an appropriate description, as seven of the 10 are islands!

Switzerland

The country has long been the home for – some would say ‘notorious, or secret’ – bank accounts. Low taxes and a banking system which, until recent relaxations, protected account holders’ secrecy, have long made the Swiss cantons a magnet for overseas funds to take advantage of low taxes. This has made the country a popular centre financially for both individuals and corporations. Capital Geneva is the 13th-largest financial centre in the world, and longest established, plus its in the centre of Europe with a reputation for neutrality in more ways than one. US companies report well over $50 billion in profits going to Swiss subsidiaries, with almost a third of Fortune 500 companies having well-used offices in Switzerland, including Morgan Stanley, Marriott, Black & Decker, Ecolab and Pepsi.

Luxembourg

This small small European country – population half a million – has laws friendly to business that allow international companies to allocate a percentage of their profits there. About a third of U.S. Fortune 500 companies have establishments in Luxembourg, including Amazon HQ through which all European sales are accounted for, although recent EU investigations have seen the company diversify profits to country of origin.

Monaco

36,000 residents live in the two square kilometres of Monaco, where residents have paid no income tax since 1869; those rich enough to be able to claim Monaco as their place of primary residence will keep all of the money they earn, however they earn it. Of course, this has attracted many of the world’s wealthiest – one in three residents is at least a millionaire – which has made real estate prices the most expensive in the world with $1 million needed to buy just 100 square metres. Corporation tax is also low, encouraging corporations such as rental car company Avis Budget Group to establish subsidiaries in there.

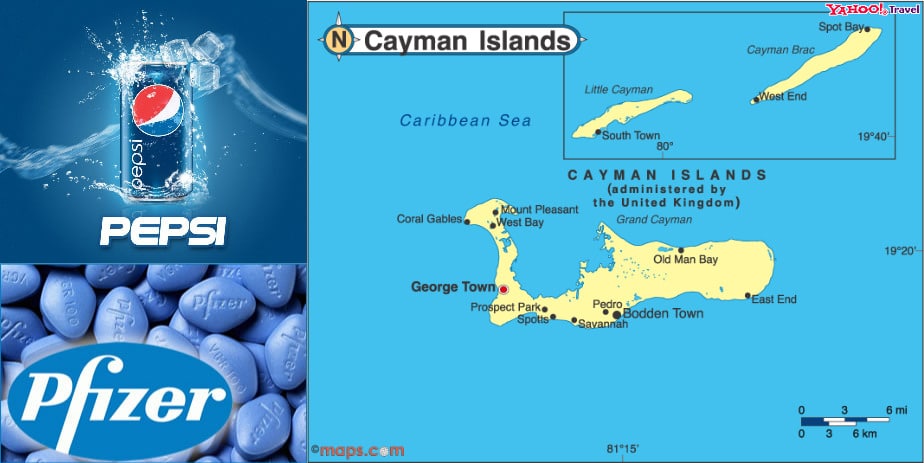

Cayman Islands

The Caribbean islands country offers what has been described as “probably the biggess tax loophole now for individuals as well as for multinational corporations.” Corporation can be formed and retain assets without paying tax, although the tax laws are somewhat complex, so a professional hand is required. However, tax benefits can be worth it, as evidenced by many businesses from around the world having assets in the Caymans, in fact estimated at equal to a 15th of the world’s total $30 trillion in banking assets, including majors such as Wells Fargo, Pfizer, Pepsi, and Marriott.

Bermuda

The Atlantic island nation has long been recognised as a tax haven – wealthy individuals can feel protected by laws of secrecy covering assets held there, even including their identities. Big businesses also benefits from Bermuda’s low taxation, including no no corporate tax at all. Again, around 25% of Fortune 500 companies have at least offices in Bermuda, perhaps most prominently Google, which routinely routes profits to Bermuda through Ireland and the Netherlands, which saves the company a minimum of $2 billion a year in taxes, reports Bloomberg.

Bahamas

No capital gains, inheritance, personal income and gift tax make The Bahamas another popular tax haven, especially to wealthy older people hoping to limit tax on inheritance or to start gifting money. US corporations have reported over $15 billion in profits making it to The Bahamas, equal to more than 125% of the country’s own gross domestic product in one year. Energy provider AES and Wells Fargo Bank are just two of the 5% of Fortune 500 companies with subsidiaries in the country.

Isle of Man

Lack of corporation, capital gains, inheritance tax and stamp duty make this destination – between England and Ireland – and also with income tax’s highest rate at 20% and total amount capped at 120,000 pounds, very attractive. Additionally, many international companies have their employee pension plans held in accounts here because of asset protection, coupled with the ability to take benefits from the age of 50. However, only employer-sponsored retirement accounts benefit from this tax code.

Jersey

Jersey’s location – between England and France – status as a tax haven has been convenient since the mid-20th Century, when many British citizens moved their wealth to the island, as Britain’s inheritance tax on amounts over one million Pounds was 80%, compared to zero in the self-governed Channel Island. Even today, there is still no inheritance, capital gains tax, and standard corporate tax, except on financial services, property and utility companies. Consequently, over $200 billion in notionally UK assets are domiciled here.

Ireland

Irish officials deny that te country is a tax haven however, this was refuted somewhat when US drug company Pfizer amalgamated with Ireland-based Allergan, and re-located its headquarters to Ireland, helping Pfizer avoid taxes on an estimated $150 billion in profits held internationally.

Apple, which has accumulated over $180 billion in profits internationally, also has HQ in Ireland, thus avoiding an estimated $59.2 billion in US taxes. Over 25% of Fortune 500 companies also have branches Ireland – one doesn’t need to wonder why!

Mauritius

In the middle of the Indian Ocean, Mauritius is a popular haven for ‘foreign investments’, with its relative proximity to India. Corporations with ‘interests’ there include Pepsi, JPMorgan Chase and Citigroup. A 15% corporate tax levy is in place, however companies that are tax residents cab gain tax breaks granted through double tax treaties. Additionally, interest and capital gains are not taxed, so it is a rather attractive tax haven.